TV Shows

9 See allLoading..

The Empress of Ayodhaya

Oct. 24, 2024Love Game in Eastern Fantasy

Nov. 01, 2024Family by Choice

Oct. 09, 2024Smile Code

Nov. 08, 2024The Story of Pearl Girl

Nov. 01, 2024Fangs of Fortune

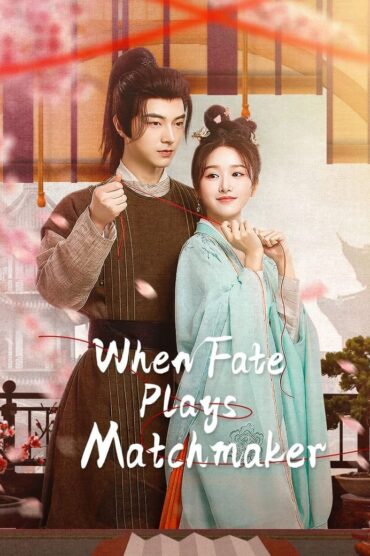

Oct. 25, 2024When Fate Plays Matchmaker

Nov. 12, 2024Hidden Love

Jun. 20, 2023Movies

0 See allLoading..